You think you are paying high taxes? Think again...

Re: You think you are paying high taxes? Think again...

Oh good. A self proclaimed socialist pontificating on the nature of taxes. Glad I didn't miss a thing.

-

Duel of Fates - SWBF2 Admin

- Posts: 2812

- Joined: Wed Aug 19, 2009 9:21 pm

- Location: I am here, and there.

- Xfire: virago777

Re: You think you are paying high taxes? Think again...

Bryant wrote:I found a graph on Wikipedia (and graphs are good)! It's important to note that the first spike is WWI, the second spike (red) is the great depression, and the third spike (blue/red) is WWII. Also, notice that before 1913 there was practically no tax (it's a wonder they ever survived for over 130 without the government's "help").If we went back to the tax-rates you were talking about, then we'd be in full wartime government operation!

That's not true... even one of your graphs which summarizes the PDF I posted clearly proves that taxes were MUCH higher from the 1930's all the way to 1981. High taxes were not there just because of the war. Besides, how can the government maneuver in another economic collapse and lower taxes if they are already too low? Then the government can barely react. In good times, taxes have to be high to stop the economy from overheating, and in bad times they have to be low. They just can't be low all the time like Reagan wanted.

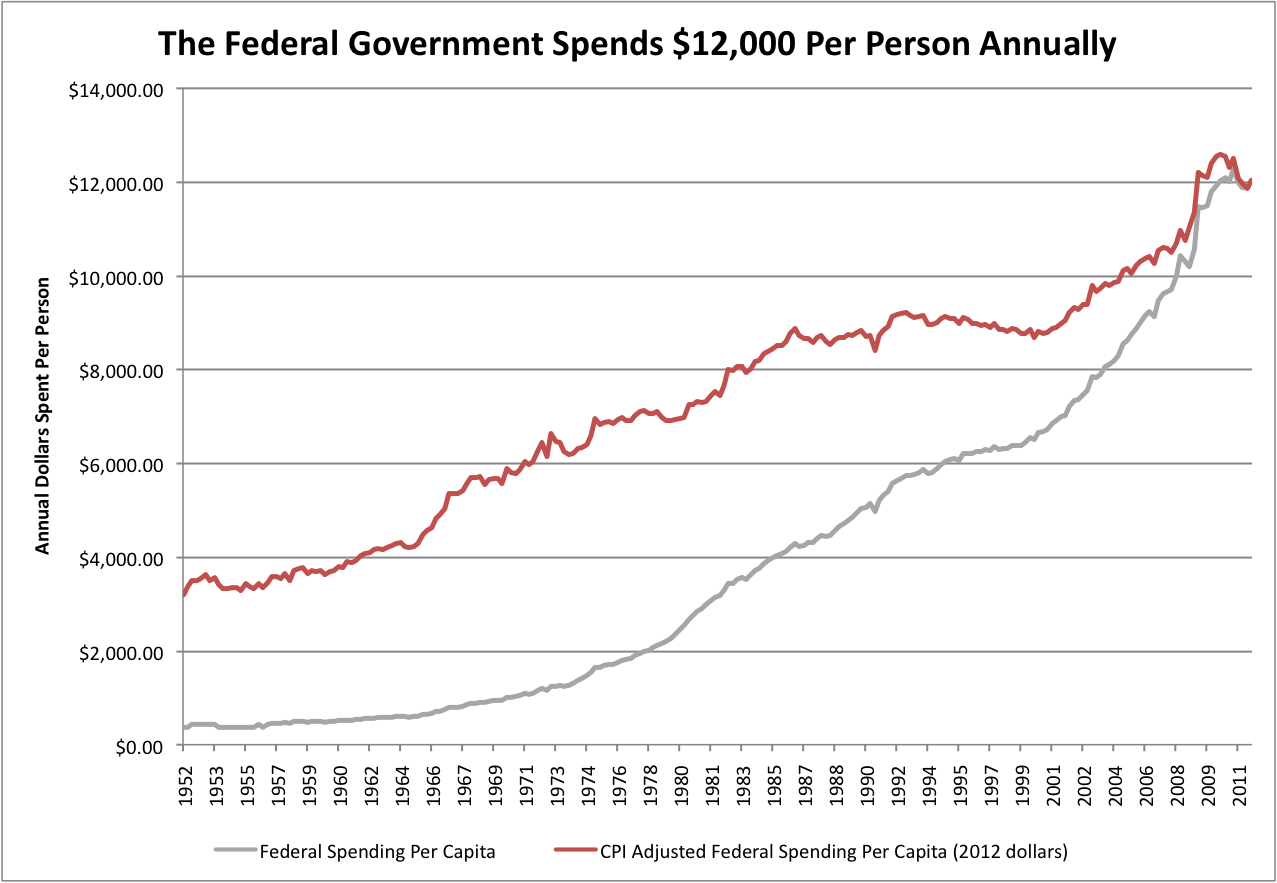

The final 2 graphs really hurts an argument about quality of roads and such, as spending has actually drastically increased since the 60's.

Of course government spending increases drastically. As every year goes by it has to increase... population increases, businesses grow..

I'm kind of skipping over the 'inequality' part of this discussion because it's so subjective as to its actual impact on society(ie. it's not representative of the poor's ability to live, upward mobility, and the driving force of the economy - to make a profit). Also, most 'anti-poverty' spending began after the 60's.

And income inequality is pretty simple and not misleading at all as some people claim (who are not economists btw). If productivity per capita is increasing but people like you and me aren't making more money, then that means 99% of the population is making less money. In other words, at this moment U.S has made more money but people are poorer. In other words, I am working more but my wages have remained the same (which means my purchasing power is decreasing). This is not misleading. On top of this, if american salaries continue to lag behind, that weakens the economy. That means you can buy less of what you produce, which means that companies make less money after a few years from now, which means that they have to fire people, which then slows down the economy.

remember, when it comes to economics, I like to destroy myth. If political ideas get in the way, someone has to unmask them. Although there are plenty of smart people in the Republican party, they are very wrong when it comes to taxes. It's not economically sound.

-

CommanderOtto - SWBF2 Admin

- Posts: 2572

- Joined: Wed Jun 13, 2012 10:30 pm

- Location: A kitchen

Re: You think you are paying high taxes? Think again...

CommanderOtto wrote: what surprises me the most is that americans paid high taxes for several decades and now they think high taxes is socialism lol. Not even the french pay so much as americans did back then. So my main point is, some people claiming that high taxes is socialism is a myth. 60 years of high taxes and the U.S was way better than today.

Otto. We have had socialists and socialist policies pushed on the citizenry far longer than sixty years. Most people do not have a problem paying their fare share. What they have a problem with is the waste, corruption, the continuation of spending when most sane people would stop, and spend less.

-

Duel of Fates - SWBF2 Admin

- Posts: 2812

- Joined: Wed Aug 19, 2009 9:21 pm

- Location: I am here, and there.

- Xfire: virago777

Re: You think you are paying high taxes? Think again...

CommanderOtto wrote:That's not true... even one of your graphs which summarizes the PDF I posted clearly proves that taxes were MUCH higher from the 1930's all the way to 1981. High taxes were not there just because of the war. Besides, how can the government maneuver in another economic collapse and lower taxes if they are already too low? Then the government can barely react. In good times, taxes have to be high to stop the economy from overheating, and in bad times they have to be low. They just can't be low all the time like Reagan wanted.

It absolutely is true. You'd be a fool to think that the government would let go of its taxes after the war or depression. However, they only got approved because of WWI, the greatest economic collapse ever, and WWII. Also, taxes don't stop the economy from 'overheating'. The only reason 'overheating' happens is when the government 'protects' business from risk, and thus allows then to get away with foolish plans (see housing market collapse - government made mortgage companies give out risky loans and protected them for it).

CommanderOtto wrote:Of course government spending increases drastically. As every year goes by it has to increase... population increases, businesses grow..

Spending per capita has increased... About tripled according to the graph below.

CommanderOtto wrote:And income inequality is pretty simple and not misleading at all as some people claim (who are not economists btw). If productivity per capita is increasing but people like you and me aren't making more money, then that means 99% of the population is making less money. In other words, at this moment U.S has made more money but people are poorer. In other words, I am working more but my wages have remained the same (which means my purchasing power is decreasing). This is not misleading. On top of this, if american salaries continue to lag behind, that weakens the economy. That means you can buy less of what you produce, which means that companies make less money after a few years from now, which means that they have to fire people, which then slows down the economy.

"Income inequality refers to the extent to which income is distributed in an uneven manner among a population." Defined by Google... It means that someone makes more money than someone else, not what you are now explaining.

What's interesting to note is that all income has increased since 1979... So if all income increases, but yours doesn't increase as much as someone else's, then you would rather go back to your smaller income...

CommanderOtto wrote:remember, when it comes to economics, I like to destroy myth. If political ideas get in the way, someone has to unmask them. Although there are plenty of smart people in the Republican party, they are very wrong when it comes to taxes. It's not economically sound.

Like I showed before, tax rate did not increase income as a % of GDP. So the government does not benefit from higher tax rates, but you are hurt. Also, even if you were to somehow say that's a fluke, Republicans have very good ideas about taxes - but also different ideas about spending. There was a time when government was about simple protections, and people had to be responsible for themselves... I'm for much smaller government, which means less spending, less taxes, and I chose were my money goes - not some criminal in DC.

Also, apparently you didn't look very long at the graphs:

First income tax was for WWI -> taxes went down but not to prewar levels

Second income tax hike for great depression - note low earners did not have tax increase

Third income tax hike was for WWII -> note large increase for low earners

Income tax returned to pre-war levels after Reagan

Tax rate went down => % of gdp revenue did NOT change

Tax rate went down => gdp went UP

Tax rate went down => revenue went UP

Spending from .5 to over 4 trillion (pop ~2x, spending 8x)

I really don't think any of this matters. It's all about the culture of the country, which right now frankly has no interest in politics and will vote for the handout. I bring this up because without an engaged population, you really talk about issues in regards to the 'social contract' - it's all about what you choose to give up in return for something else. Even if people chose to give up some income to help the poor (for example) but don't follow through to make sure the government is doing an appropriate job then it's just hollow pity. It think that's how I might describe the majority of our country (and most countries for that matter): "What's in it for me?" and hollow pity. No amount of economics, regulations, taxes, or laws can keep a great nation going - only the people can.

Edit: This is kinda a bit of a side note: I recently got to visit DC because I have an internship nearby for the summer. I really enjoyed seeing the museums, monuments, Capitol building, and such. When walking around the mall and seeing these imposing and grandiose buildings, the thought occurred to me that it's no wonder the people who work here are so out-of-touch with the rest of the country, lol.

-

Bryant - SWBF2 Admin

- Posts: 678

- Joined: Fri Nov 13, 2009 12:50 am

- Xfire: ssmgbryant

Re: You think you are paying high taxes? Think again...

Bryant wrote:CommanderOtto wrote:And income inequality is pretty simple and not misleading at all as some people claim (who are not economists btw). If productivity per capita is increasing but people like you and me aren't making more money, then that means 99% of the population is making less money. In other words, at this moment U.S has made more money but people are poorer. In other words, I am working more but my wages have remained the same (which means my purchasing power is decreasing). This is not misleading. On top of this, if american salaries continue to lag behind, that weakens the economy. That means you can buy less of what you produce, which means that companies make less money after a few years from now, which means that they have to fire people, which then slows down the economy.

"Income inequality refers to the extent to which income is distributed in an uneven manner among a population." Defined by Google... It means that someone makes more money than someone else, not what you are now explaining.

What's interesting to note is that all income has increased since 1979... So if all income increases, but yours doesn't increase as much as someone else's, then you would rather go back to your smaller income...

It is what I explained. I'm talking about income per capita and income inequality. There is much more to income inequality than just a one line definition put by google. If income per capita increased, that doesn't mean that people are living better. It is just a division of income by population. It is skewed or in other words, it is not representative of what is happening. Not everyone earns almost 50k a year. You have to add in income inequality to complete the picture. Then it is not misleading because you see what really is happening. Both are studied together. Instead, a handful are making trillions (something only seen in the very unequal 1920's) and everyone else lagging behind. Why should the growth rate of everyone's income go slower than that of the 1% when in the past they grew at the same rate? What makes them better human beings for their salary to grow faster than the rest of the people when it used to be the same growth? There will always be people richer than others, but the economy is not growing as healthy as it used to.

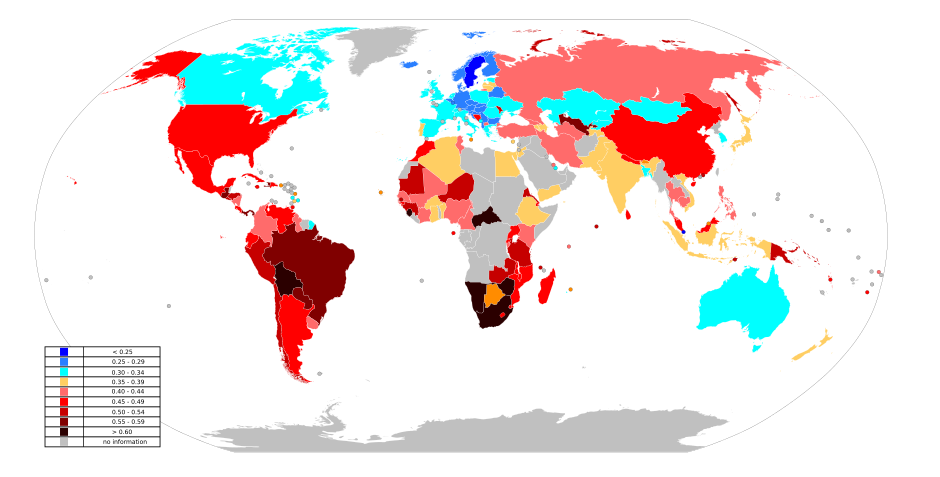

Just look at this map of the Gini coefficient... and look how all the crappiest countries have the highest income inequality.

or look at what income inequality does to countries like brazil:

People over there can be extremely RICH but right on the other side of the wall people don't even have proper sewers.

or how about the extreme inequality of the 30's before the war? People like the Rockefeller living like aristocrats while other people lived in shantytowns?

and... No, I would rather pay more taxes and see that the government has more money to invest in universities, schools (which have become terrible), highways, a social security that works by the time I retire...

but you are right, spending per capita increased, but didn't you just say that social security/medicare didn't exist back then? So what if spending per capita increased? As long as people live better it doesn't

er. Old people live longer and better lives... increased spending in education diminishes crime and poverty. Healthy, educated people are more productive...

er. Old people live longer and better lives... increased spending in education diminishes crime and poverty. Healthy, educated people are more productive...Bryant wrote:CommanderOtto wrote:That's not true... even one of your graphs which summarizes the PDF I posted clearly proves that taxes were MUCH higher from the 1930's all the way to 1981. High taxes were not there just because of the war. Besides, how can the government maneuver in another economic collapse and lower taxes if they are already too low? Then the government can barely react. In good times, taxes have to be high to stop the economy from overheating, and in bad times they have to be low. They just can't be low all the time like Reagan wanted.

It absolutely is true. You'd be a fool to think that the government would let go of its taxes after the war or depression. However, they only got approved because of WWI, the greatest economic collapse ever, and WWII. Also, taxes don't stop the economy from 'overheating'. The only reason 'overheating' happens is when the government 'protects' business from risk, and thus allows then to get away with foolish plans (see housing market collapse - government made mortgage companies give out risky loans and protected them for it).

Dude, I study this everyday and will probably have to study this for a living as well. One major economic tool is to raise or lower taxes. The federal reserve is not the only one controlling the economy. If the market is doing bad, you lower taxes. There is a whole subject in economics about this: fiscal policy. The economic crisis we just had was a soup of a variety of problems. Yes you are right, the government did a terrible job at financial regulation, but you are wrong when you say the "only reason overheating happens is when the government protects business from risk." Taxes cooldown economies when increased and heat up when lowered... it's not something that is debatable.

Last edited by CommanderOtto on Mon Jun 23, 2014 2:40 pm, edited 1 time in total.

-

CommanderOtto - SWBF2 Admin

- Posts: 2572

- Joined: Wed Jun 13, 2012 10:30 pm

- Location: A kitchen

Re: You think you are paying high taxes? Think again...

and I know it is very difficult for the eyes to read so much in such tiny letters (at least that's my case), but if you hold on a little more read this.. a quote from an article in The Economist (moderate conservative by the way, and even they admit the situation is bad):

Whatever its causes, the stratification of American society is having profound consequences. A country that prides itself on its social mobility is already less mobile than most people think and is almost certainly becoming even less so. As the box with the previous article showed, standard measures of inter-generational mobility in America are lower than in Canada and much of Europe. Most of this has to do with the difficulty of escaping from the bottom rungs of America’s income ladder. According to Markus Jantti, a Finnish economist who has studied mobility across countries, more than 40% of the sons of the poorest 20% of Americans stay in that quintile, compared with around 25% in Nordic countries. The evidence is mixed on whether social mobility has lessened or simply stayed the same over the past 30 years. But it is clear that there has been no improvement in mobility to compensate for widening inequality.

And even the most recent studies of social mobility look at the earnings of people who were children over two decades ago. Since disparities in income, education and social behaviour now strongly reinforce each other, future mobility might be a lot lower still. A study by Sean Reardon of Stanford University suggests that the gap in standardised test scores between schoolchildren from high- and low-income families is roughly 30-40% bigger today than it was 25 years ago. Bob Putnam, of Harvard University, puts it starkly. Put away the rear-view mirror and look at future social mobility, he says, and “we’re about to go over a cliff.”

Last edited by CommanderOtto on Mon Jun 23, 2014 2:29 pm, edited 1 time in total.

-

CommanderOtto - SWBF2 Admin

- Posts: 2572

- Joined: Wed Jun 13, 2012 10:30 pm

- Location: A kitchen

Re: You think you are paying high taxes? Think again...

Income equality means that everyone is equally poor. You prefer that or some people being poor and some being rich and the rich people trying to make even more money by investing, which creates more jobs...etc.

Because some people are always going to be poor no er what you do.

er what you do.

I'm personally unemployed/studying, so I'm quite poor actually and I understand that it's just a phase I'm going through. I am spending the money to get a good job in the future.

Because some people are always going to be poor no

er what you do.

er what you do.I'm personally unemployed/studying, so I'm quite poor actually and I understand that it's just a phase I'm going through. I am spending the money to get a good job in the future.

-

(SWGO)DesertEagle - Community Member

- Posts: 438

- Joined: Wed Jan 02, 2013 4:37 am

- Location: In the land of irony

Re: You think you are paying high taxes? Think again...

(SWGO)DesertEagle wrote:Income equality means that everyone is equally poor.

oh man, that is not what income equality means. Say that to your grandparents who lived in the 60's. SO all americans who lived from 1930's to 1981 were poor? and im not saying that there shouldn't be rich people or poor people... that will always happen in this world. Increased income equality does not mean that inequality disappears. There will always be, just that it shouldn't be as bad as it is today. Political ideas do not mean they are good for the economy. Conventional wisdom here is wrong. Lower taxes for rich people mean they get rich at everyone's expense. Not very different from the aristocrats from before the french revolution. And even though crater is also politically guided, he is right, pure and simple.

-

CommanderOtto - SWBF2 Admin

- Posts: 2572

- Joined: Wed Jun 13, 2012 10:30 pm

- Location: A kitchen

Re: You think you are paying high taxes? Think again...

CommanderOtto wrote:Lower taxes for rich people mean they get rich at everyone's expense.

But they don't pay lower taxes than everyone else, they actually pay more, even with a flat rate, so it's not "at everyone's expense."

They earned their money, they are entitled to it.

If you eliminate tax brackets, you reduce the need to pay games with the system to get into a lower bracket.

And splitting hairs on "well people below 20k don't pay so it's not really a flat rate" is not helpful.

-

(SWGO)DesertEagle - Community Member

- Posts: 438

- Joined: Wed Jan 02, 2013 4:37 am

- Location: In the land of irony

Re: You think you are paying high taxes? Think again...

Bryant wrote:Like I showed before, tax rate did not increase income as a % of GDP. So the government does not benefit from higher tax rates, but you are hurt. Also, even if you were to somehow say that's a fluke, Republicans have very good ideas about taxes - but also different ideas about spending. There was a time when government was about simple protections, and people had to be responsible for themselves... I'm for much smaller government, which means less spending, less taxes, and I chose were my money goes - not some criminal in DC.

Growth in GDP is not the measure for the economic and/or social result of higher/lower tax rates. That neglects the country's gain with respect to the construction of more hospitals and more schools, increased funding to disease and space research programs, etc.

First income tax was for WWI -> taxes went down but not to prewar levels

Second income tax hike for great depression - note low earners did not have tax increase

Third income tax hike was for WWII -> note large increase for low earners

Income tax returned to pre-war levels after Reagan

Tax rate went down => % of gdp revenue did NOT change

Tax rate went down => gdp went UP

Tax rate went down => revenue went UP

Spending from .5 to over 4 trillion (pop ~2x, spending 8x)

The country's gross economic growth during the periods you mention has very little to do with lower taxes. It can be ascribed to increasing globalization, the lowering of international tariffs after the Depression, and the growth of multinational corporations that maintain workforces and outlets in multiple different countries. Changes in the income tax (for the top 1%) have never drastically affected the growth of the economy.

I found a graph on Wikipedia (and graphs are good)! It's important to note that the first spike is WWI, the second spike (red) is the great depression, and the third spike (blue/red) is WWII. Also, notice that before 1913 there was practically no tax (it's a wonder they ever survived for over 130 without the government's "help").If we went back to the tax-rates you were talking about, then we'd be in full wartime government operation!

LOL, prior to 1913 the country was isolated - there was little regular interaction with foreign powers, and it wasn't such a great time. Besides, the government made money by taxing whiskey, furs, and other luxury items (which, guess what, were purchased primarily by the wealthy).

Duel of Fates wrote:Oh good. A self proclaimed socialist pontificating on the nature of taxes. Glad I didn't miss a thing.

The ad-hominem does nothing to reduce his credibility. Sure, his views influence his thinking, but he has every right to contemplate tax laws and the same right to share his view with others - especially considering that what he's saying is true.

Desert Eagle wrote:Income equality means that everyone is equally poor. You prefer that or some people being poor and some being rich and the rich people trying to make even more money by investing, which creates more jobs...etc.

You would make a fantastic modern newscaster. Why? Because you love soundbites, simple rhetoric you can throw at people without substantiating anything. That isn't true at all, LOL. What facile argument you did include is actually inaccurate, as reductions in tax rates have NOT seen corresponding increasing in corporate investment or hiring. What really happens is that the executive's salary is boosted, pension plans are extended, etc.

(SWGO)DesertEagle wrote:CommanderOtto wrote:Lower taxes for rich people mean they get rich at everyone's expense.

But they don't pay lower taxes than everyone else, they actually pay more, even with a flat rate, so it's not "at everyone's expense."

They earned their money, they are entitled to it.

If you eliminate tax brackets, you reduce the need to pay games with the system to get into a lower bracket.

And splitting hairs on "well people below 20k don't pay so it's not really a flat rate" is not helpful.

Anyone who lives on unclaimed land is entitled to all the money they make, yes. If you move to a small, uninhabited, never-before-seen Pacific Island, find a gold mine and sell the gold to tourists who stop by (because exporting it would make you subject to tariffs and sales taxes in other countries), you can keep ALL of your money. BUT, when you live in a civilized society, you cede some of your income for your (and others') benefit.

Because we, as people, rely on each other, we are responsible for each other. You pay taxes to support the military that protects your shipping routes, you pay taxes to support the poor so that they can afford to send their children to college (where, after graduating, they may come work for you), you pay taxes to pave the roads so you can travel, you pay taxes to support federal agencies that regulate food and water so you don't die of contamination, you pay taxes to support the overall health of the economy so that you can stand to make even more, and you pay taxes to support the hospitals so that if/when any of your family becomes chronically ill, they have a place with access to specialists and sub specialists who provide good care for them.

And if someone has abundant reserves of cash, they should pay a higher percentage of that income than someone who doesn't.

Love and Pepsi are the two most important things in life.

-

(SWGO)SirPepsi - Community Member

- Posts: 867

- Joined: Thu Oct 27, 2011 12:53 pm

- Xfire: sirpepsi

Return to Non-Game Discussions

Who is online

Users browsing this forum: No registered users and 23 guests